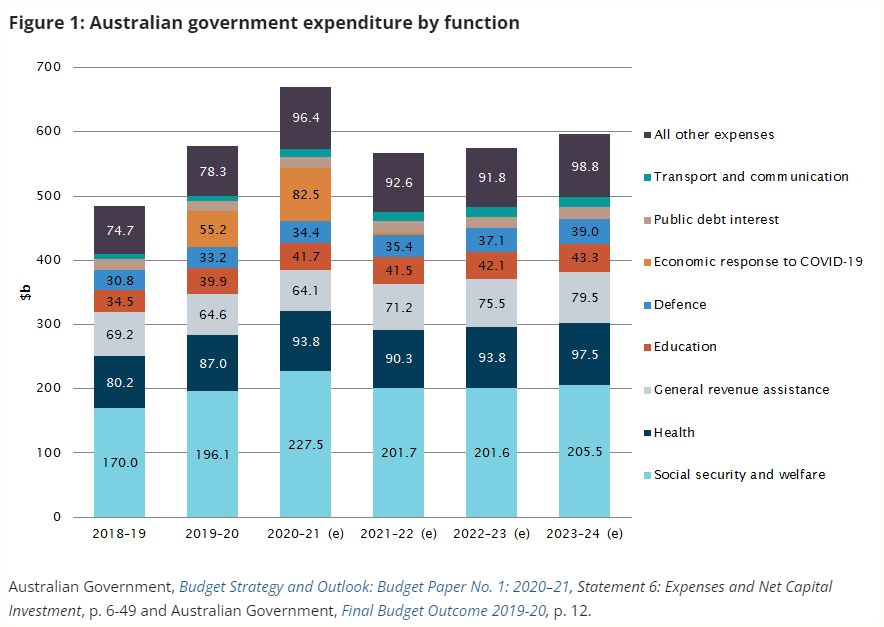

The government's economic response to the pandemic was substantial, with significant expenditure across several financial years. In the 2019-20 financial year, the response totaled $55.2 billion, peaking at $82.5 billion in the 2020-21 financial year, before reducing to $2.9 billion in 2021-22, and further down to $0.25 billion in 2022-23. This response accounted for up to 12.3% of government expenditure in 2020-21 and had a notable impact on the proportion of GDP during these years. In summary $141 Billion.

Now the ATO are chasing a total of $54 Billion to be period, which is overdue to the exchequer (in most cases). What is the right balance here? $34 Billion is owed by SME businesses, many of whom will be sole traders, with their houses likely on the line, and have suffered with dramatic interest rate increases and an economic downturn at the same time.

Where is the balance?

Summary:

- The Australian Taxation Office (ATO) is pursuing over $34 billion in debts from small businesses and self-employed Australians, debts that were deferred during COVID-19.

- This aggressive debt collection is contributing to a rise in insolvencies, potentially surpassing post-Global Financial Crisis levels.

- Many affected businesses are in struggling sectors like construction, hospitality, and retail.

- The ATO's actions include reporting debts to credit agencies, issuing garnishee notices, and initiating wind-ups, with total collectable debt doubling since 2019 to $52.4 billion. Critics argue that while tax compliance is mandatory, the ATO's heightened enforcement could imperil small businesses further.

#insolvency #business #cashflow #ato